|

|

Class Warfare In The U.S. |

|||||||||||||||||||||||||||||||||||

|

How The Ultra-Wealthy Have Exploited The System, At Our Expense |

|||||||||||||||||||||||||||||||||||

|

Class Warfare In America Since 1992, the bottom 90% of Americans have had their incomes rise by a mere 13%, compared with an outlandish increase of 399% for the top 400.

Under the Bush II tax cuts for

the wealthy, the richest 400 Americans doubled their personal wealth, while

at the same time cutting

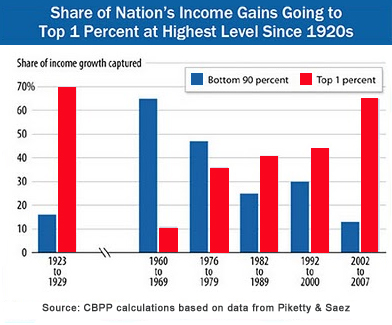

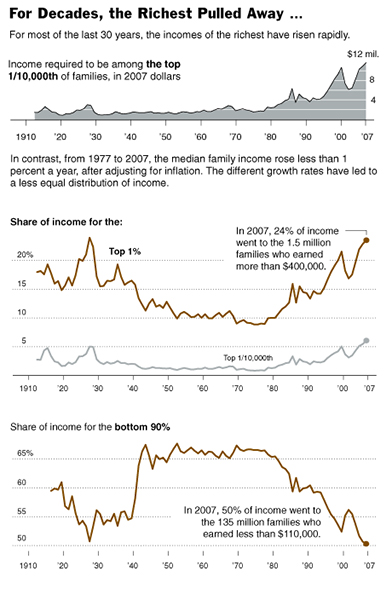

their tax rate in half. Right. How does something so monstrously devastating and earth shattering just creep up all of a sudden on the country, unbeknown, out of the blue, like this did? The official stance is that Hank Paulson and Ben Bernanke and the entire banking cartel that runs the Federal Reserve had no idea this was coming. Not a clue. Zip. Seriously? Is it reasonable to believe that no one actually saw this coming? Not Paulson, Bernanke, Geithner, or anyone else financially savvy on Wall Street or at the Fed... not one person saw this coming? Really? If this is so, it's a pretty damn scary thing to admit, because what then does that say for our economic system? How can we expect to be protected in the future, if they were truly incapable of seeing this coming? Many with severe short term memory attempt to place the blame for the economic crisis on the Obama administration, however they would be remiss in failing to attribute that the true origins of the economic collapse were engineered during the previous Bush-Cheney administration, just one more life altering major disaster to add to their eventful watch on America. An Unforeseen Disaster? As insidious and awful as it sounds, many are now taking a 9/11-type position on the collapse, alleging that this economic crisis has been carefully engineered and orchestrated for a calculated effect, in this case, an assault on the middle class of America, to bring it to its knees. The first tip is that allegedly no one saw this coming. (Wink-wink, nudge-nudge.) The second tip was the urgent, "no time left" scare tactic, the outrageous extortion threat from Henry Paulson demanding $700-billion immediately from Congress. According to the heavy hand of Hank, either we were to pay the TARP or suffer the consequences. Paulson then actually had the audacity to threaten the possibility of martial law in America. That is blatant, clear-cut criminal extortion. A third tip that one might openly entertain... despite the worst economy since the great depression, the vast majority of the ultra-rich have profited wildly under the Bush tax cuts, even more so during the last two years of a crippling economic nightmare. How was that inordinately large profit possible during such a crisis, when the rest of middle-class America was in the midst of losing its wealth, its housing, and its jobs? So Bush bailed out the corporations and the bankers with the first of two $700-billion+ TARP payments, with President Obama coughing up the second extortion payment. Once again, despite the dire economic crisis, the ultra-wealthy have profited hugely, just as they did during the first great depression. The paper trail left behind so far for this devastating economic disaster is rife with evidence of manipulation, unethical behavior, and treacherous greed, so Americans are wise to ask questions about how and why this happened. If things were truly that bad off, then how were they able to profit so successfully during such a near-nuclear economic meltdown? In the world of high finance, heavy profits generally come from direct involvement. Those that openly question this event have every right to do so, given the numerous documented unethical circumstances involved. In the days of "Perry Mason," profit from a crime was always considered motive for the crime. From the financial numbers coming in so far, there are enormous profits to take note of, literally hundreds of billions in good old fashioned "motive." If all of this sounds too much like conspiracy talk or something out of the lunatic fringe, then you might want to delve back into history and examine the nefarious machinations behind the Great Depression. That event was manufactured for the prosperity of the banking cartel that owned the Federal Reserve. Ultra-rich banking tycoon JP Morgan leaked word that a New York bank was about to go insolvent, causing an overwhelming run on the banks, helping to facilitate the economic collapse and great depression. [Life magazine, April 25, 1946, "Morgan The Great"] The current economic crisis very much seems to be a carbon copy repeat of the Great Depression, with the ultra-rich buying up struggling companies for mere pennies on the dollar, shamelessly increasing their greedy stranglehold on the American way of life, while vastly increasing their own personal fortunes. There is solid IRS evidence to back up the allegation that the rich have prospered excessively under a rigged system in their favor, while at the expense of the poor and middle class. Under the Bush II tax cuts for the wealthy, the richest Americans doubled their fortunes while also cutting their tax rate in half. That is clearly an extraordinary feat, yet at the same time is a vile, disgusting, economic perversion, considering the disparity that the poor and middle class have to contend with daily. The result of this unbridled greed is not just bad news for the lower class, but a direct threat against the middle class as well. It should be readily admitted by most now that the Reaganomics "trickle-down" theory simply does not work as a reliable economic engine. The ultra-wealthy do not always reinvest, more often than not pocketing their tax breaks to inflate their wealth. Rather than increasing production or investing in research & development, the majority just grow richer and far more powerful when given generous tax breaks from the government. This is now a proven historical fact, substantiated by IRS data that proves beyond a shadow of a doubt that the rich became vastly richer after the Bush tax cuts for the ultra-wealthy. If the Reaganomics "trickle down" theory actually worked, then ask yourself why we have spiraled into an economic meltdown WITHIN seven to eight years after the Bush tax cuts for the 1% that own it all. Apparently a "trickle" is all that came down. This is a damning indictment on the conservative theory that giving tax breaks to the ultra-rich will eventually trickle down to the middle and lower classes. If indeed that principal were true, we wouldn't have had the horrific economic disaster that erupted from eight years of Bush II. Who Benefits? One of the first things the Bush-Cheney administration did was to cut the tax rate for the wealthiest Americans, thus the extraordinary income growth for the rich. This was the main catalyst for the richest 400 Americans to double their incomes during that time, all the while their tax rate was nearly cut in half, dropping from 29.4% to a paltry 16.6%. That tax rate is much lower than the typical rate paid by Americans with low six figure incomes. For the wealthy elite, this costs them about as much or basically equal to what they earned in the first three hours of 2007. Okay, so let's get this straight now... they DOUBLED their incomes during Bush II, while at the same time getting their tax rate cut nearly in HALF. Wow! What a sweet deal for someone who doesn't need the financial help. Warren Buffet, the third wealthiest man in the

world, worth an estimated $47-billion,

spoke once at a

$4,600-a-seat fundraiser in New York for Senator Hillary Clinton

where he said to the wealthy

before him, “The

400 of us pay a lower part of

our income in taxes than our receptionists do, or our cleaning

ladies, for that matter. If you’re in the luckiest 1 per cent of

humanity, you owe it to the rest of humanity to think about the

other 99 per cent.” In regards to the Republican argument on extending the Bush tax cuts for the rich, Buffet is not a subscriber of the argument that letting tax cuts expire for the wealthy would hurt economic growth. Buffet reiterated his stance in an interview with ABC's Christiane Amanpour saying, "If anything, taxes for the lower and middle class and maybe even the upper middle class should even probably be cut further, but I think that people at the high end -- people like myself -- should be paying a lot more in taxes. We have it better than we've ever had it." Amanpour challenged Buffet's comments by stating, "They say you have to keep those tax cuts, even on the very wealthy, because that is what energizes business and capitalism." Buffet replied, "The rich are always going to say that, you know, just give us more money and we'll go out and spend more and then it will all trickle down to the rest of you. But that has not worked the last 10 years, and I hope the American public is catching on." He then punctuated that position by saying, "There's no sacrifice among the rich." So there really need be no government care whatsoever for the rich, because they quite obviously don't need it. The necessity for government in regards to the wealthy should be in a regulatory role, to protect the rest of society from the extremely rich who historically tend to oppress, if not enslave, the middle and lower classes, when they are given no oversight. One can make a factually compelling and very strong argument that the present system is not spreading the wealth with any sane, rational proportion for a healthy society. Instead, it is dangerously coalescing it into concentrated elite groups that are already fabulously wealthy, increasing their long established wealth and power. In a one-year time span during the Bush-Cheney administration, the average income of these wealthy-elite increased from $263.3-million in 2006 to a whopping $344.8-million per year in 2007. Obviously the very well off affluent wealthy now want to keep this recent gift horse from Republicans as a permanent tax cut, but for what morally responsible reason? Extending the Bush tax cuts would give millionaires more in tax breaks than 90% of Americans will actually earn for the entire year. That is an abomination of good conscience, most especially during the current economic conditions. The wealthiest one percent of the U.S. has received $715-billion from the Bush tax cuts over the last ten years, nearly three-quarters of a trillion dollars! By extending the Bush tax cuts, the richest 1% would get $60,000 in additional tax breaks per year. Millionaires would receive a $150,000 annual break. In a ten year period, that totals $1.2 trillion in lost revenue. These ultra-wealthy elite received a 27 percent increase in their annual income. This is nine times the rate of increase for the bottom 90 percent. Here's an extra piece to chew on. Since 1992, the bottom 90 percent of Americans have had their incomes rise by a mere 13 percent, compared with an outlandish increase of 399 percent for the top 400, and yet in 2010, the Republicans are bashing the Obama administration for having the temerity to undo the sinful Bush-Cheney tax cuts for the rich. Republicans want to keep the Bush tax cuts for the wealthiest Americans, people who are exceedingly well off, many who helped create this current economic crisis. At the same time they are talking about digging us out of the hole they created by taking it out on the poor, those affected most by the crisis. And this is the "religious" conservative right? Wow, way to embrace Christianity. So much for "WWJD." (What would Jesus do?) Greed of the Wealthy The disparity of wealth in the world today is an aberration for a self proclaimed civilized, moral society. The divide that exists has grown ever wider between the rich and the poor. According to a new study, the Credit Suisse Research Institute in Zurich has found that the number of global adults worth over $50 million each appears to be considerably greater than a decade ago. Even with the financial industry meltdown, Credit Suisse reports, “the past decade has been especially conducive to the establishment and preservation of large fortunes.”

In a recent newspaper article, "The fast track to inequality", reporter Bob Herbert of the St. Louis Post Dispatch observes that the top CEOs in America all saw their incomes increase 5 times during just the last year of the Bush administration. Fives times in one year! What American worker ever gets more than one raise in a year? FIVE raises for corporate CEOs in the last year of the Bush administration. Absolutely unconscionable. Talk about outrageous avarice, audacity and just plain blind hubris... Five! A case could be made that capitalism and wealth are out of control in America. Morality within the industry of big money is simply not part of the equation when it comes to the bottom line, with ethics taking a distant backseat to profit and wealth. Being rich isn't just enough for some. Many have taken the Parker Brothers game of Monopoly to the real life extreme, and we all know how miserable the game can be when one person dominates the board and owns it all. People need to come to grips with the fact that our U.S. brand of capitalism has been running unchecked for years, in a rigged game that favors the outrageously wealthy elite. Keep in mind that these are the same obscenely rich families that changed the language of the "estate tax" to the "death tax." The ultra-wealthy want the middle and lower classes to falsely believe that there is a tax upon our death, when nothing of the sort is true. What is true is that there is a tax upon large lucrative estates of the wealthy, an attempt to keep the outrageous vast fortunes of this 1% in check, lest they become more powerful than the government. They have manipulated the language to get the middle and lower classes to say no to a tax that is meant only for the wealthy upper class. So not only are they dishonest and greedy, but conniving and immoral comes to mind as well. The Numbers Don't Lie The new Global Wealth Report crunched financial data from over 200 countries worldwide. The following is what they found...

Fact: No other nation on Earth has as much total wealth as the United States. A new book by political scientists Jacob Hacker of Yale and Paul Pierson of the University of California-Berkeley, titled, "Winner-Take-All Politics: How Washington Made the Rich Richer — and Turned Its Back on the Middle Class," makes the case that since the late 1970s there have been dramatic policy changes in the U.S. government that favor the wealthy, hands down, over middle America. Huge corporations coalesced to overwhelm our system with the big money lobby, tilting the laws in favor of the extremely rich. In just two or three decades, the course of the U.S. has been bought and paid for by big money, steered by the ultra-wealthiest of the US (less than 1% of the total population) so that the laws favor the wealthy elite and not the average American. As a result, the middle and lower classes have been in decline ever since. Thanks to the Bush tax cuts, the top 1% wealthiest are earning as much today as they did at their all-time peak, in the 1920s, just after the formation of the Federal Reserve cartel, when the ultra-wealthy took control of the nation's monetary system.

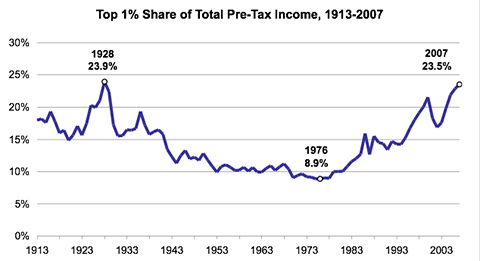

Just recently the New York Times reported that corporate profits were the highest ever recorded, at an annual rate of $1.659 trillion in the third quarter, according to a Commerce Department report released on November 22, 2010. According to the Times, "It is the highest figure recorded since the government began keeping track over 60 years ago, at least in nominal or non-inflation-adjusted terms." Arguably the most damning statistic of all would be IRS data on income before taxes, considered pre-tax income. According to IRS data, the top 1% wealthiest more than doubled their pre-tax income from 1976 to 2007, vaulting from 8.9% to 23.5%, the second highest figure ever since the takeover of the Federal Reserve. This was to be a critical juncture for our economy and the harbinger of disaster. Ever since the Federal Reserve took over US monetary policy, there have been two peaks in the pre-tax income of the top 1% uber-rich, in 1928 (23.9%) and again recently in 2007 (23.5%). Both times this has happened we have had the largest economic catastrophes in our country's history. Using history as an indicator, high percentages of income such as these for the top 1% wealthiest appear to be a foreboding indicator for economic disaster. One year after each peak, the US stock market crashed. After the 1928 peak, it crashed one year later in 1929. After the recent 2007 peak, once again the market crashed just one year later in 2008. It indeed seems that a direct correlation can be made to these peaks of wealth. The question should be asked, why was nobody paying attention to this? Pre-Tax Income for the Richest 1% of Americans

since the Beginning of the Federal

Reserve Takeover. One other question might be asked... now that we've given the rich even more money and further expanded their wealth through a $1.5 trillion bailout... that 2007 peak figure of 23.5% is sure to grow even higher, likely breaking the record set in 1928 just before the great depression. With the last thought in mind, there are some very bright people in Washington and on Wall Street. Knowing full well the historic consequences of what happened the last time the pre-tax income was over 23%, why then didn't someone in the Bush administration act sooner? Again, they all claim nobody saw this coming, but with available stats like the graph above, how does anyone miss or ignore the potential ramifications? The Rich Get Richer: Blind Luck or Manipulation? Apparently despite the horrible economy, the world's wealthiest are making money. As we've seen so far, it's not just small change either, but a doubling of fortunes for many of the richest. To see so many of the ultra-wealthy becoming far richer under allegedly horrible economic conditions, you have to wonder just how bad things really are for them. Just as in the first great depression, the wealthy elite have profited handsomely while snapping up struggling businesses for mere pennies on the dollar. At some point, considering that the genesis of the crisis originated with Wall Street and they're the ones profiting, you have to give serious consideration to manipulation and motive, as was the case in the first great depression. [Life Magazine 04/25/46] One fact that might support the engineered economic collapse theory is that despite the horrible economy, the number of billionaires in the world rose from 793 in 2009 to 1,011 in 2010. That's 218 new billionaires, created during arguably the worst economic downturn in history! Those of extreme wealth are profiting big time.

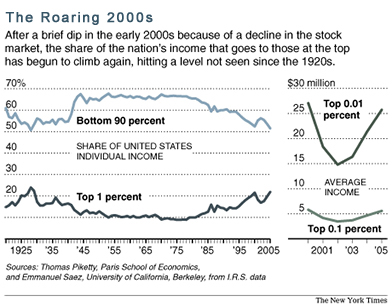

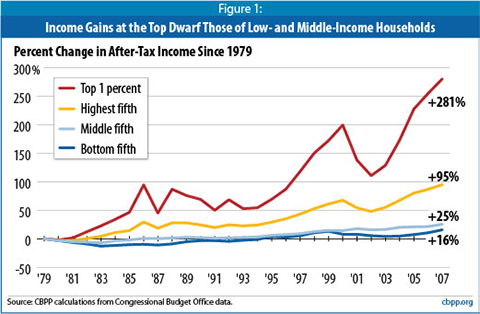

To see a net growth of $1.2-trillion for this group during such a crippling economic environment is notable and most eye opening. Questions do arise. During the Bush-Cheney years, from 2001 to 2008, the income gains of the top 1% increased a whopping 62%. After-tax incomes for the top 1% soared by an average of 281%, or $973,100 per household. Within this 1% the largest increase went to the top 0.1% who had the highest total ever since 1913, the year the Federal Reserve took over the US currency system. According to David Cay Johnston, a Pulitzer Prize-winning former reporter for The New York Times, the incomes for the biggest earners in the US, ($50 million-plus annually) grew over fivefold from 2008 to 2009, a remarkable feat considering that the country was in the midst of the worst economic collapse since the Great Depression.

When we have a very small elite group of people earning multiple-billions in just one year, something is out of line with our brand of capitalism. One could make the case for a rigged or unfair game. At this point, it is time to consider more regulatory oversight, not less, to make sure all business practices and ethics are above board. For example, the top Hedge Fund Manager of 2009 (David Tepper) made $4 billion in income. Four BILLION dollars in just one year! That is unfathomable for most. As for the rest of the top ten, they each respectively earned: $3.3 billion, $2.5 billion, $2.3 billion, $1.4 billion, $1.3 billion (tie for 6th and 7th place), $900 million (tie for 8th and 9th place), and $825 million (10th place). Wow. That's a boatload o' cash for a one year salary! Are you starting to get the picture here with all of these prosperous stats? The system is lopsidedly rigged in their favor, a fact which is substantiated by their continued obscene profits, even during a horrible economic collapse. Its almost as if they just can't lose. Oh sure, they lost a little overrated stock value at the start of the crisis, but in the end they are still opulently wealthy beyond any comparison for 90% of Americans. It should be quite clear to all that the rich are doing very well indeed, prospering outrageously during one of the worst top two economic disasters of all-time, so we certainly don't need to worry about extending the Bush tax cuts any longer for the top 10% richest to insure their survival. A case could be made that the current crisis is evidence that there was no tangible stimulation of the economy, no "trickle-down effect," due to the Bush tax cuts. Just look where we ended up. All we did was to inflate the value of the richest on Forbes' list of wealthiest Americans. Question... so is this indicative of a system that works for a functioning society or is it a sign of a flawed system that works against it, one that is broken and easily exploitable for those with no moral scruples? Sadly, the rich Republicans and the wealthy elite will always defend this type of system, no matter how detrimental it is to society, while the middle and lower income classes are forced to bear the brunt of its shortcomings. The disparity in income in the U.S. is the worst now since the formation of the Federal Reserve, just before the Great Depression, the first "engineered" economic collapse in U.S. history. According to figures from the last quarter century, over 90% of the total growth in income went to the top 10% earners in the US. This leaves a diminutive 9% of all income to be shared by the bottom 90% of Americans. The enormous disparity of wealth is troubling on a societal scale, however when the game is purposefully rigged to favor the elite, that chasm is criminal and immoral and needs to be rectified before the middle and lower classes are totally destroyed. The Dangers of Excessive Wealth The elite ultra-wealthy that own it all, the 1,011 billionaires of the world, are the ones to keep a watchful eye on. The U.S. has 403 of those billionaires, a disproportionate figure when compared to the rest of the world. The U.S. also has 41 percent, of the world’s millionaires, despite having only 5.2 percent of the world’s population. That is an inordinate percentage of total international wealth to come from one country. The top 400 in American wealth are all billionaires. From William Ford Sr. (Ford Motor Company) with $1-billion, to Bill Gates (Microsoft) with $54-billion, the richest top 400 are but only 0.00013029037979808572 percent of the U.S. population. This tiny number isn't even close to the 1% figure that is said to own it all, yet these 400 individuals are without a doubt the richest of all. Even though these wealthy elite are an infinitesimally diminutive figure in comparison to the 310-million plus Americans, they own an overwhelming vast majority of the nation's property and wealth. The real danger that exists is, what happens if two or more of these members of outlandish wealth should ever ally together in a criminal cause? The disposable income that they can afford to lose on a cause or for an agenda is an imposing and dangerous figure, one which is offset and made possible due to the tremendous money stream of continual income that they receive. They can throw millions into a project, knowing full well that they literally have millions more coming right back in, without ever jeopardizing their overall total wealth. An ever flowing fountain of disposable cash to fight their battles and serve their agendas. That is a formidable opponent in any arena. That is the danger of having too much money. That concept may seem strange to some because of the "winner take all" capitalism we've been taught to espouse, but truth is reality and anytime a private citizen has enough money to threaten the state and the well being of the public, then that is simply too much. Some might claim this to be nothing more than paranoid delusion, but they would be remiss in recognizing that such a threat from the wealthy has already presented itself and has been documented at least twice in the last one hundred years alone, both times with significant adverse consequences for the poor and middle class of the U.S. (See the 1910 Jekyll Island coup and also the 1933 bonus army rebellion.) The Ultra-Rich Takes, But Gives Not Conservatives should take a hard look at the August 2008 GAO report which states quite clearly that nearly two-thirds of U.S. companies and nearly 68% of foreign companies do not pay federal income taxes. The Government Accountability Office (GAO) examined samples of corporate tax returns filed between 1998 and 2005. In that time period, an annual average of 1.3 million US companies and 39,000 foreign companies doing business in the United States paid no income taxes, despite having a combined $2.5 trillion in revenue. These corporate free loaders burden our tax-paid infrastructure by wearing down our roads with their massive delivery trucks, yet they essentially leave it up to us to pay the bill for our nation's highways and roads. They burden us with environmental pollution, but expect the American taxpayer to clean up after them for their spills and other ecological disasters. They deplete our raw materials for their own profits, all the while destroying our basic infrastructure. That's capitalism from the world of Bizarro. Corporations fight for our personal retail patronage, while also fighting for our state and federal tax money, then they reap the benefits of tremendous wealth, all the while paying no taxes back into a rigged system that is forced back upon the middle and lower classes, leaving us to pay for everything. Where is the fairness in that? We continue to spend at historic levels for military defense, as much as $708-billion under the Obama administration. That is a 6 to 1 ratio over our next closest rival, Russia, and a 7 to 1 ratio over China. We are clearly overspending on defense and burdening our society as a direct result. We are feeding the military industrial complex, rather than caring for our own, or furthering our society. The U.S. far outspends the rest of the world on arms, combined. If it was Russia or China spending that much on their military, most Americans would find that to be overly aggressive, so where do we morally draw the line so that defense spending does not inhibit the advancement of society? A great many of the wealthy helped contribute to this latest economic catastrophe, yet who did we bail out? The rich! The US government all but guaranteed that the ultra-rich would be financially protected and thus be able to maintain their immense personal fortunes through the government stimulus bailouts, all the while average everyday Americans were having their home mortgages foreclosed on and having to declare bankruptcy. And it's still going on! Again, where is the fairness? The everyday taxpayer received a couple small token checks for a few hundred measly dollars, but those that were the most well off were lavished with a personal safety net of hundreds of billions. The obvious message there is that you can't have the wealthy losing their own money to save their own businesses. Instead, they try to protect the upper class because they're considered by some to be the engine of society, but there is no gas from the middle class to run that engine with when the middle and lower classes are bled to death financially. Righting The Ship The fight is now on between Democrats and Republicans in an attempt to propose a workable solution to the economic crisis. The Democrats are fighting hard to save the middle class, while trying to lift the lower class up. Meanwhile, across the aisle, the Republicans are fighting fiercely for some of the richest people on the face of the earth, trying to make the lives of the ultra-wealthy even more profitable, even though they are well enough off and need no help whatsoever, most certainly not from our hard earned tax dollars. As a responsible society, we cannot possibly, in all good conscience, take from Social Security, Medicare and necessary social programs to balance the budget. That would have to rate as one of the most immoral proposals that anyone could ever consider. Those particular social programs did not carry this country into debt, it was the runaway defense spending, a corrupt Federal Reserve system, and out of control pork-barrel political spending excesses, all way beyond good reason. We need to cut from our number one excess and that is clearly defense spending. Let's face it, we are over spending now and could easily cut $300 to $400-billion out of the annual defense budget and still continue outspending opponents by a ratio that is nearly four to one. Taking hold of excessive pork barrel spending would also make a huge dent in our yearly national budget. Rescinding the Bush tax cuts for the ultra- wealthy would easily bring us close to $1-trillion in annual revenue to help pay down the national debt. America has always prospered when the excessively wealthy were held accountable for taxes, something we are not doing at present, due to the Bush tax cuts for the extremely rich. Those tax cuts for the rich were just that, "cuts,' but times are now tough and the rich had ten years to make hay, a great many of them actually doubling their vast fortunes during that period, so it's time now for the wealthy to understand that those cuts did not help our economy. The IRS data proves that the 1% richest did not invest those tax cuts back into the economy, but instead pocketed them for their own personal profit. Matt Krantz from USA TODAY reports that “Cash is gushing into company’s coffers as they report what’s shaping up to be a third-consecutive quarter of sharp earning increases. But instead of spending on the typical things, such as expanding and hiring people, companies are mostly pocketing the money or stuffing it under their mattresses.” According to the Washington Post: “Sitting on these unprecedented levels of cash, U.S. companies are buying back their own stock in droves. So far this year, firms have announced they will purchase $273 billion of their own shares, more than five times as much compared with this time last year… But the rise in buybacks signals that many companies are still hesitant to spend their cash on the job-generating activities that could produce economic growth.” Wow. So the fat cats that own it all would rather pocket that money instead of increasing their hiring and production. The reality is, the rich have been investing instead in their own corporate shares, to prop up share prices and artificially inflate their stock to be more attractive to Wall Street. They're not worried about middle-income Americans. Their religion is the bottom line in the corporate ledger book. The fact is, we are not raising taxes on the rich as much as we are merely going back to a previous tax rate that made sense for the country in meeting its bills. The privilege of wealth and being able to profit from the people, or at the expense of the people, should involve a plan for giving back. There used to be such a scale in place, however the Bush tax plan for the 1% ultra-rich was allowed to cut that rate, for a time. Those cuts are now set to expire at midnight on December 31st, 2010. If we're going to right our economy, it should no longer be off the backs of the middle class. You do not improve a society by spending more on war and weapons, while also cutting from education, Medicare and Social Security. If the rich want weapons and war to protect and fight for their corporate hegemony, then it's time that they pony up from their own wallets and quit sucking the life out of necessary social programs for the needy. The War Is On There is class warfare in this country, make no mistake about it. Just as the super-rich tried to do-in FDR and establish a fascist regime in America, with the Morgan family, the DuPonts, the Remingtons and Prescott Bush's involvement, etc, (see bonus army revolution and General Smedley D. Butler) they are now working to do it again. What is increasingly clear is that capitalism, in its present form, is a perversion against humanity, no better than the alleged oppressions of communism, or the fabricated false charges that are made against socialism. Our capitalism has sadly turned to fascism, with a fancy new name, "corporatism." No one wants to admit that we're now under the trappings of fascism, so they try to wrap it up in a new less-Nazi associated term. Corporatism or fascism, whatever you want to call it, is a system that looks at "we the people" as merely labor and consumption. “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.” -Warren Buffett, 112606 NY Times With so many middle and lower class Americans hurting to the point where they have lost their jobs and homes, it's quite unsettling to see those that don't need the money being catered to at the expense of those who are hurting the most. To see the 1% wealthiest become even richer during an economy said to be arguably the 2nd worst ever, if not the worst in the modern era, well... you have to ask yourself just how grave the situation truly was to begin with. Many are starting to believe that we've been had, set up and duped in one of the biggest scams ever in history, just as we were for the first great depression. The argument in this country should not be about left versus right, but rather should be about society versus huge private wealth. We should be concerned with fixing an unfair economic system that has long been taken over by an elite banking cartel that oppresses "we the people," while severely threatening the foundation of our country and the dream that our forefathers so valiantly and persistently fought and died for. Yes Dorothy, there is a huge distinction in class in the US, but this isn't just class warfare, it's fast becoming class Armageddon, with the middle class square in the cross-hairs. Orchestrated or not, the net effect of this latest economic collapse is that the obscenely wealthy of America are growing much richer and more powerful, all at our expense. And when those who are the most well off shout vehemently against a redistribution of wealth in the US, then you know that there is indeed class warfare in America. Most disconcerting of all, as Warren Buffet says, their side is winning. See Also:

|

|||||||||||||||||||||||||||||||||||

|

22 Statistics That Prove The Middle Class Is Being Systematically Wiped Out Of Existence In America |

|||||||||||||||||||||||||||||||||||

|

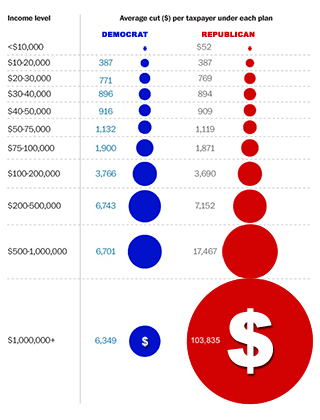

Rachel Maddow On The Bush Tax Cuts Rachel Maddow - Lame Duck Watch: The Bush Tax Cuts Democratic tax plan versus Republican plan Oh the horror and hardship. How ever do they pay their servants and still afford the exorbitant yacht maintenance and slip fees?

Republicans Choose The

Wealthy Over Economy |

|||||||||||||||||||||||||||||||||||

|

Socialism? The Rich Are Winning the US Class War: |

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

BAILOUT STIMULUS: We're On The Hook Bush $700-Billion + Obama $800-billion = $1.5-Trillion $1.5 Trillion ... divided by 310,639,619 US pop = $4,828.74 each |

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

The L

Curve: Income Distribution In The US

Predatory Capitalism: How The Poor

Get Poorer

American Capitalism |

|||||||||||||||||||||||||||||||||||

|

The system is lopsidedly rigged in their favor, |

|||||||||||||||||||||||||||||||||||

|

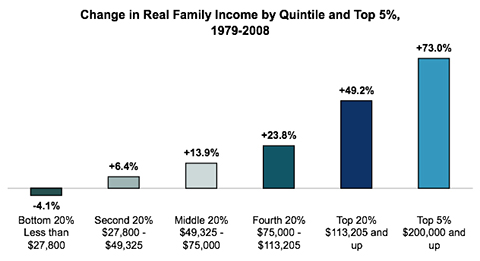

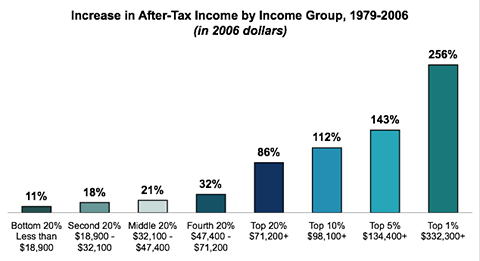

After Tax Income From 1979 Through 2007  Source: Congressional Budget Office (CBO)

Real Family Income (click on the graph above for a larger

version.)

After Tax Income (click on the graph above for a larger

version.)

Who Owns America's Wealth? |

|||||||||||||||||||||||||||||||||||

|

BY THE NUMBERS:

|

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

Bill Moyers: Plutonomy And Democracy Do Not Mix |

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

MONEY IN AMERICA: THE FACT$ |

|||||||||||||||||||||||||||||||||||

|

THE RICH 83% of all U.S. stocks are in the hands of 1% of the people. 66% of the income growth between 2001 and 2007 went to the top 1% of all Americans. Only the top 5 percent of U.S. households have earned enough additional income to match the rise in housing costs since 1975. For the first time in U.S. history, banks own a greater share of residential housing net worth in the United States than all individual Americans put together. In 1950, the ratio of the average executive's paycheck to the average worker's paycheck was about 30 to 1. Since the year 2000, that ratio has skyrocketed as high as 500 to one. Average Wall Street bonuses for 2009 were up 17 percent compared with 2008. The top 1 percent of U.S. households own nearly twice as much of America's corporate wealth as they did just 15 years ago. Despite the financial crisis, the number of millionaires in the United States rose a whopping 16 percent to 7.8 million in 2009. The top 10 percent of Americans now earn around 50 percent of our national income. |

|||||||||||||||||||||||||||||||||||

|

THE POOR The bottom 90 percent have been saddled with nearly 75 percent of all debt (73%). 61% of Americans live paycheck to paycheck. (49% in 2008 and 43% in 2007.) The bottom 50 percent, half of income earners in the United States now collectively own less than 1 percent of the nation’s wealth. More than 40 percent of Americans who actually are employed are now working in service jobs, which are often very low paying. For the first time in U.S. history, more than 40 million Americans are on food stamps, and the U.S. Department of Agriculture projects that number will go up to 43 million Americans in 2011. (Nearly 1/7th of Americans, or roughly 13%.) Approximately 21 percent of all children in the United States are living below the poverty line in 2010 - the highest rate in 20 years. Forty-nine million people in the US are able to eat only because they receive food stamps, or visit food pantries and soup kitchens for help. That is an outrageous and disgraceful number for the wealthiest nation on earth, nearly 1/6th of the population. Sixteen million are actually so poor that they missed regular meals or were forced to forego eating in the last year, due to lack of food. This number is alarming because it is the highest level since statistics have been kept, according to the US Department of Agriculture, Economic Research Service. A record 2.8 million homes received a foreclosure notice in 2009, up from the two years previous. That rate is expected to be rise to 3 million homes in 2010. Eleven million homeowners in the United States, nearly one in four homeowners, are technically “under water,” a dire situation where they owe more on their home mortgages than their house is actually worth. The largest inequality in the world today between rich and poor, among all Western industrialized nations, is in the much vaunted United States, "land of the free." The divide has continually been exaggerated and forced even wider over the last forty years by the ultra-rich lobby on Capitol Hill. The basic cost of living in America, housing, education and health care have all increased at a dramatically much higher rate than wages and salaries. Over 2/3rds of global adults have an average wealth of less than $10,000. About 1.1 billion of these adults hold

a net worth of less than $1,000. |

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

Rachel Maddow: Bernie Sanders Message On The Rich Ignored By Media The GOP Tax Bonus For

The Rich Ignores Failed Reaganomics. |

|||||||||||||||||||||||||||||||||||

|

If the

Reaganomics "trickle down" theory actually worked, |

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

From CrooksandLiars.com:

November 11, 2010 08:00 AM The survey of voters who cast ballots last Tuesday -- conducted by Democratic pollster PPP and commissioned by the Progressive Change Campaign Committee -- found that when respondents were given the choice between cutting the defense budget, raising taxes on the wealthy and cutting Social Security to reduce the deficit, just 12% said they'd like to see the entitlement program cut. Forty-three percent said they'd prefer to see taxes on the wealthy go up, and 22% said cutting the huge defense budget was the best way to go. The PCCC hailed the result as evidence that voters are not ready to embrace the conservative economic agenda, even after they just voted a huge number of new conservatives into Congress...read on No matter how loud Conservatives scream about tax cuts and the dismantling of Social Security, Americans overwhelmingly do not want their SS messed with, and they are all for taxing the rich. Real Americans aren't buying the bullshit trickle-down theories that FOX and other Wall Streeters demand their zombie-like followers consume like dead brains. The idiotic Cat Food Commission is going to advise that entitlements gets cut. That will only lead to another disaster for the working class that families cannot withstand.

November 10, 2010 07:00 AM 10 Epic Failures of the Bush Tax Cuts 10 Republican Lies About the Bush Tax Cuts

Study: Bush Tax Cuts

Cost Over Twice As Much As Dems' Health-Care Bill |

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

Michael Moore On The

US Plutonomy |

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

Concentration

of Wealth For The Rich Is The Greatest On Record! Thank You George W. Bush For Not Taxing The Top 1% Of The Rich 15 Mind-Blowing Facts About Wealth And Inequality In America The Widening Gap In America's Two Tiered Society Why America Now Supports Taxing the Rich A Historic Breakthrough For U.S. Billionaires Our Economy Is Going to Keep Tanking...

American Capitalism: Economic Dysfunction |

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||

|

Source Material:

The World's Billionaires

Forbes.com |

|||||||||||||||||||||||||||||||||||

Return to

NewsFocus.org |

In

case you haven't noticed, there is a growing sentiment among a great many in

this country, questioning the devastating economic collapse and how it is that

so many incredibly intelligent people from the Federal Reserve, the central

banks, the Wall Street financial sector, and the government, all failed to see

this giant economic tsunami coming. With all of its close ties with the US

government, you would think that the vaunted brain-trust of Goldman Sachs would

have seen this coming. Well, perhaps I should maybe rephrase that a little...

you would have hoped that Goldman Sachs and the other megalithic titans of

the financial sector would have warned the government. By their own admission,

they excel at the business of recognizing financial trends, yet we're expected to believe that these

self-professed money masters didn't see this

coming, until it was too late.

In

case you haven't noticed, there is a growing sentiment among a great many in

this country, questioning the devastating economic collapse and how it is that

so many incredibly intelligent people from the Federal Reserve, the central

banks, the Wall Street financial sector, and the government, all failed to see

this giant economic tsunami coming. With all of its close ties with the US

government, you would think that the vaunted brain-trust of Goldman Sachs would

have seen this coming. Well, perhaps I should maybe rephrase that a little...

you would have hoped that Goldman Sachs and the other megalithic titans of

the financial sector would have warned the government. By their own admission,

they excel at the business of recognizing financial trends, yet we're expected to believe that these

self-professed money masters didn't see this

coming, until it was too late.